Not known Factual Statements About Investment Advisors

Table of ContentsThe Best Strategy To Use For Investment AdvisorsThe Definitive Guide to Investment Advisors3 Simple Techniques For Investment AdvisorsThe 2-Minute Rule for Investment Advisors

Even when you die before the full time frame, your recipients are going to carry on to receive the annuity. Round figure This option allows you to decide on a single money remittance now, in swap for no further remittances. 4) When intending your retired life revenue, it is actually vital to take income taxes into point to consider. Eventually, there are 3 various tax procedures in retirement life. The initial procedure is taxed funds, which need to be actually reported on your tax yield as well as is subject to tax obligation. Instances include advantage gotten in savings account and taxable increases on sell in a broker agent account when you offer it. The 2nd tax treatment is tax-deferred. Your tax-deferred.profiles are actually accounts where you really did not pay out tax obligation on your addition or venture capital. Instances of tax-deferred profiles are 401(k )s as well as IRAs. These accounts likewise expand tax-deferred, so you don't pay for tax obligation as they enhance in market value. Rather, when you pull money out of these profiles, your drawbacks will certainly be taxed as average earnings. With a tax-free profile, the income taxes were paid out on the contribution, therefore growth and also withdrawals are actually certainly not taxed, just as long as you follow IRS guidelines. Examples of tax-free profiles are internal connections, Roth IRAs, as well as specific kinds of money value insurance coverage. Along with a very clear income planning that takes income taxes right into profile, it might be actually possible to proactively lower your income tax bill during the course of retirement life. Generally, the greater your total assets, the higher influence retired life tax tactics can possess.

Nonetheless, creating intentional retired life income program selections around income taxes can easily cause notable income tax savings for many Americans, while neglecting tax obligation planning might possess excruciating tax obligation repercussions. 5 )The means you spend ought to modify as you near retirement life. This is cash you're relying on accessing in the temporary. You'll wish to shield this amount of money coming from market dryness as well as decide on really conventional economic equipments

This pail secures funds you won't need to have to gain access to for 4-6 years. It secures traditional financial investments that will definitely replace the short-term pail when run through. 6 )Some of the biggest possessions several Americans have is their house. For some Americans, a viable approach is actually to downsize their home by selling it, and also after that utilize a section of the increases to finance retired life.

Not known Factual Statements About Investment Advisors

Uncle Sam has actually created this technique work from a tax obligation standpoint. Presently, if you are married, you can exempt approximately$500,000 of increases when you sell your home(this exception is enabled every pair of years ). Regardless of why you function, the extra revenue you create will definitely additionally be consisted of in your program as it can easily reduce the volume of resources needed to have to attract down for

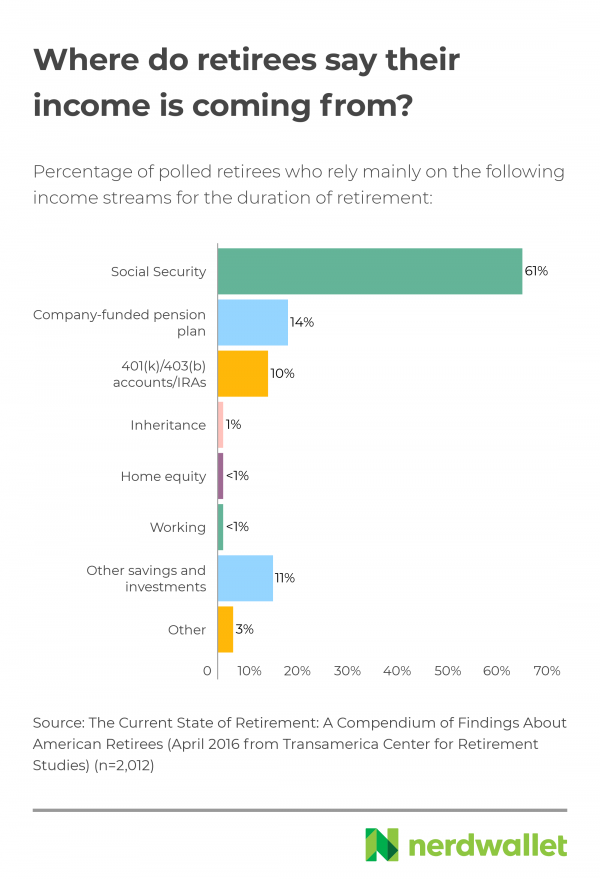

money flow. Utilizing your current way of life as a foundation, you can easily envision what expenses may lessen or even go away a little one's university expenses or home loan repayments, as an example as well as which might improve, like travel or health care costs. You can after that create projections about your profit. What perform you count on to acquire coming from your stake in a company or even land ownership? Rental building earnings? Retirement or other financial investments? Pensions? Social Security? For customers whose profit desires and also needs are rather closely matched, it assists to do precise preparing that forecasts the profit flow as well as costs for each year.

A pension is an insurance coverage item that gives the customer along with an assured revenue permanently. When buying a retirement life annuity, you may do therefore as a quick or even deferred alternative. For a lot of older grownups, quick allowances are much more prominent because they start paying within a month of being purchased.

If you prefer to let your main increase just before receiving payments, you choose for a postponed annuity. Commonly, those experiencing retirement will take money made during their functioning years to buy an urgent pension.

Some Known Details About Investment Advisors

Deposit is best, but without a calculated withdrawal strategy you could end up losing your savings along with years delegated live. Strategic you could look here withdrawal includes a technique for reversing your money as well as utilizing it as capital besides enabling what you still have in cost savings to continue to work with you.

Marketing & Editorial Acknowledgment Last Updated: 1/26/2023 top quality verified Quality Verified If you're moving right into retirement life, the last trait you wish to bother with is actually exactly how you'll proceed to bring in loan. Getting revenue without operating can be actually made complex for older adults, however it is actually possible. It is actually necessary to recognize your alternatives and recognize possible hoaxes.

A pension is an insurance product that delivers the buyer along with an assured profit forever (investment advisors). When obtaining a retirement pension, you can possibly do therefore as an urgent or prolonged option. For a lot of more mature adults, instant annuities are a lot more prominent due to the fact that they begin spending out within a month of being actually purchased.

Get This Report on Investment Advisors

If you prefer to allow your main rise prior to acquiring payments, you opt for a postponed allowance. Commonly, those facing retirement will take money gained throughout their working years to buy an urgent allowance.

Annuity value lessens over opportunity: As an end result of rising cost of living, your investment value will definitely decrease over opportunity. Secure earnings remittance: Your profit remittance will never increase along with an annuity.

Deposit is ideal, however without a strategic withdrawal strategy you might end up running out of your financial savings along with several years entrusted to reside. Strategic drawback consists of a strategy for withdrawing your cash and utilizing it as capital aside from enabling what you still have in savings to remain to work with you.